Why do banks never turn any technology off?

Let’s be honest it isn’t just banks, it's most big companies. A new system is brought in but the “legacy” system isn’t turned off and runs alongside the new system for ever - less usage but still there…

Leaving an ongoing legacy of complexity and cost!

There’s so many reasons this happens

- from project governance and funding

- to time-to-market short-cuts

- or simply not knowing what the old system is used for

Banks end up locked-in to systems

In a word complexity!

Complexity doesn’t come from mistakes or incompetence. It’s entropy. It comes from time and layers of process upon process. At the time it made sense because it worked - it always does in the context of a single project.

Transformation is hard, so banks approach everything as projects. Nobody ever steps back and takes a holistic approach to think about the capabilities that should be enabled.

Chasing efficiency of project spend and time leads to short-cuts. It’s a false economy.

It allows vendors to land and expand because “it’s easy” to do something in their system or via an add-on to it.

But it’s not the right place architecturally.

The business wants a quick result so architecture principles are kicked to the long grass!

The system vendor is now in control and the architecture is dancing to their tune. It’s a route to vendor lock-in and at that point the vendor has all the economic power!

So how do you fix it? → Start thinking in terms of capabilities, not systems.

What is a system supposed to do? Define it and stick to it!

Move from monoliths to composable building blocks behind business API layers.

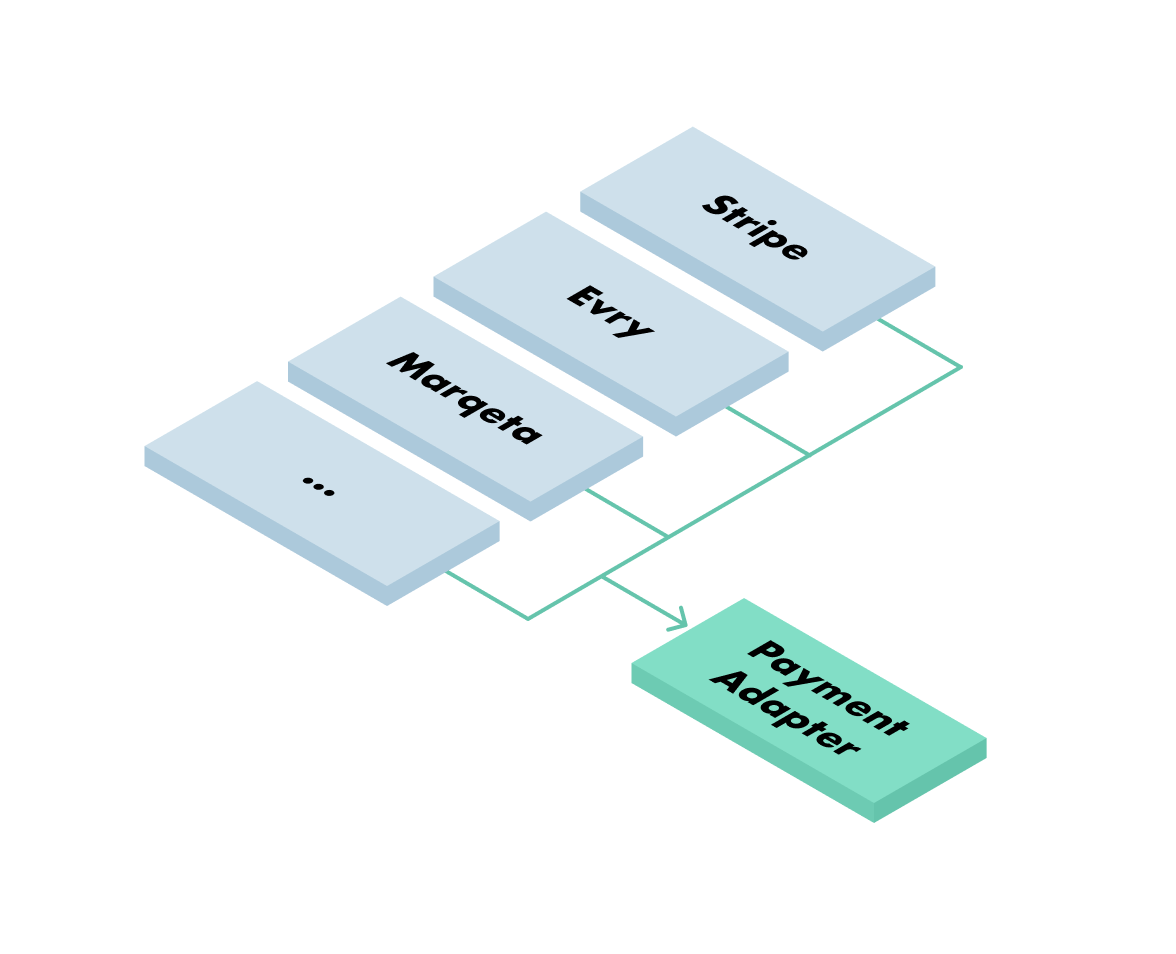

Allow your business logic to be abstracted behind a clean API rather than tightly coupled to any one provider or product. Why not have an internal Stripe type capability for all payments?

Suddenly you’re not locked in. You’re in control. You can swap vendors without rewriting the logic. You have a clear capability map that stops putting the wrong things into the wrong systems allowing you to innovate faster. You have the flexibility to change and move by removing the dependency on underlying systems in the architecture of the business flows.

That’s the idea behind FoundryOS.

Take back control!

FoundryOS gives you the power to plug-and-play providers without touching the business logic that drives your customer propositions.

✅ Swap your KYC provider.

✅ Change your payments processor.

✅ Add new integrations fast

Our adapter model and configurable platform decouple your business flows from underlying systems - putting you back in control.

With our Marketplace, you get access to pre-integrated vendors and the flexibility to connect new ones quickly. No rework. No lock-in.

And who are we?

We are FoundryOS

We’re building the future fabric of Financial Services